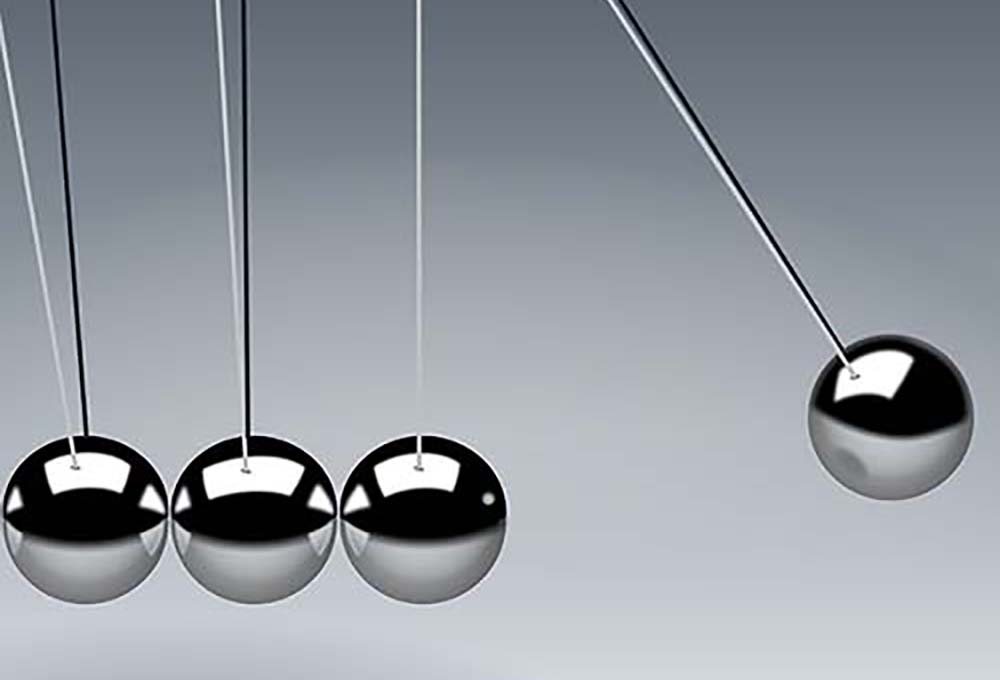

On Twitter the other day, I saw a graphic from Dan Egan that perfectly illustrates how it feels to have a diversified portfolio. It’s either outperforming or underperforming your benchmark. Although your rational mind might know a balanced portfolio is best, the ups and downs rarely feel good.

In our opinion, 2018 hasn’t been an unusually weird year for the markets. However, it has been a departure from what we’ve seen in the last year or two. In our recent memory, nearly everything went up together – domestic stocks, international and emerging market equities, even bonds. It was a great time to be diversified because without taking additional risk, we saw great returns! Unfortunately, that’s not the case this year.

So far, bonds have taken a hit (-1.6% in total return*), the emerging markets sector** is down nearly 5% and international equities*** are holding steady for the most part. It’s all part of the game. However, when you’re holding sectors^ that may be down nearly 5% year-to-date while the S&P 500^ is up nearly 6% (at the time of writing this), sticking with a diversified portfolio^ can be hard. You might be wishing for the returns of 2016 and 2017.+

We preach that diversification is important, but we understand it also isn’t sexy. However, when the market finally dives like the talking heads on TV have been saying for more than five years, you may be feeling good and grateful for your old, faithful friend Diversification. The hard part is waiting until then. Keep a level head and realize that this year isn’t weird, but the last few years might have been.

Blog by Andrew Gaskill, Financial Services Manager.

^Note: Diversification does not assure or guarantee better performance and cannot eliminate the risk of investment losses. Investments in individual sectors may be more volatile than investments that diversify across many industry sectors and companies. Certain sectors of the market may expose an investor to more risk than others. An investment cannot be made directly into an index.

Sources:

*https://www.investopedia.com/terms/t/totalreturn.asp

** https://www.msci.com/documents/10199/c0db0a48-01f2-4ba9-ad01-226fd5678111

*** https://money.stackexchange.com/questions/8089/what-is-an-international-equity

+ https://personal.vanguard.com/us/funds/tools/benchmarkreturns

Category: Financial Service Team, Leaders, Market Matters