As we wrap up the first quarter of 2020 and look back at what we’ve just been through, it feels like we’ve seen two years’ worth of news and market events in just three months. While we’ve experienced some form of epidemic or pandemic (SARS, MERS, Swine Flu) in the past few decades, we’ve not seen something of quite this magnitude. It’s understandable to be fearful. Not only are we at risk of contracting an illness that we don’t know how to fight, but we’ve been quarantined at home and the markets have tumbled from their all-time highs. You might have the urge to move to cash and wait this out or reallocate your funds from equities to something else, but that might not be your best move – and here’s why.

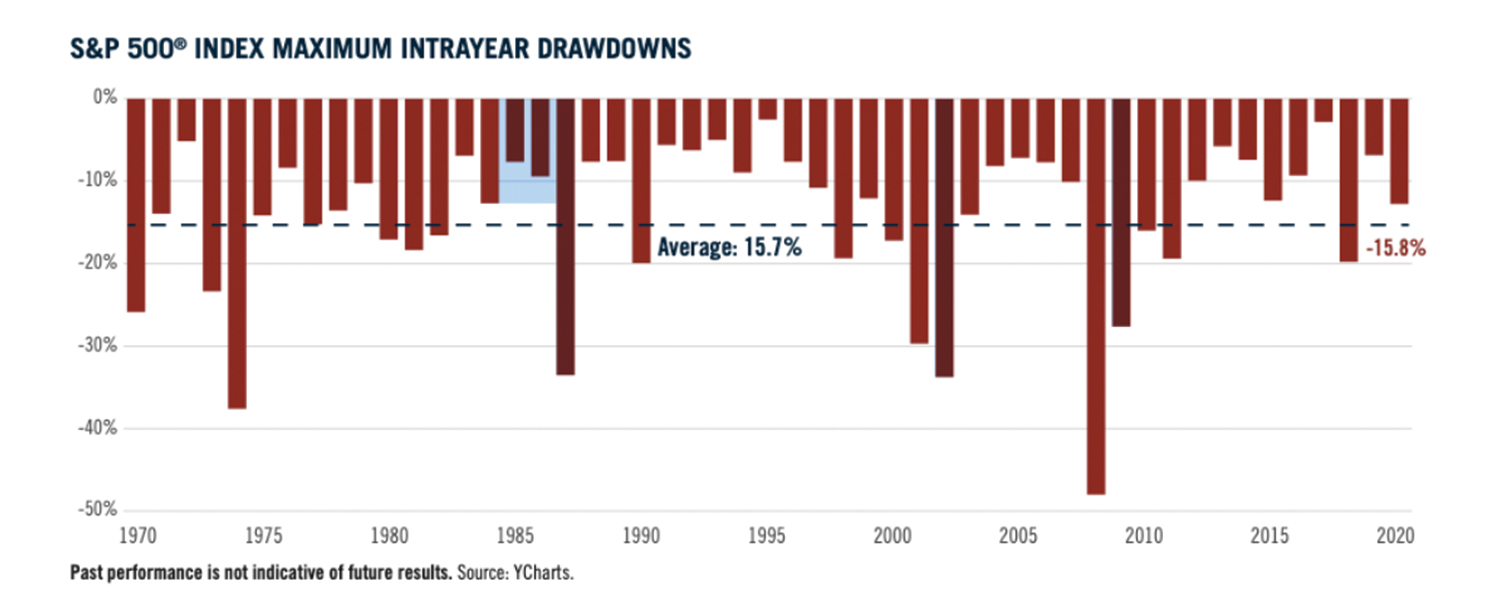

1. Volatility is nothing new. While we don’t tend to see swings in the markets with the same pace we’ve just experienced, it’s not uncommon to have large drawdowns during the year. This chart from Virtus shows us that on average intra-year drawdown is 15.7%.

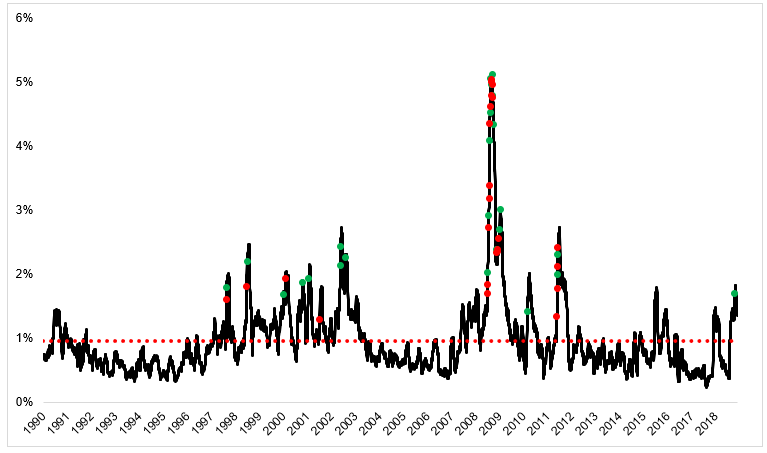

2. Often, the best days are commingled with the worst. While it seems counterintuitive, many of the best days the market has are interspersed throughout a sell-off or bear market. When the Dow started to accelerate its pace in early March, it also posed the two largest point increases in its history. This image from Michael Batnick shows just how commingled these days are. The green dots represent the best days and the red represent the worst. While we like to think we can sell when the going gets tough and buy when things get better, it’s extremely difficult to tell when things are actually “better.”

While we’re always looking for ways to maximize the returns in our portfolios, our main objective is to ensure you’re set up to achieve your goals. By making irrational, reactive moves, we might be putting you at risk of meeting those targets. We’ll always have your best interests in mind as we design portfolios, and we’ll always be here to help quell your fears about the markets. We don’t know how long this will last, but it won’t last forever and if we work together to make the best decisions today, we’ll be well aligned when we emerge on the other side.

Don’t hesitate to contact us if you have questions or concerns.

Category: Financial Service Team