On March 18, 2020, President Donald Trump signed the Families First Coronavirus Response Act into law. This legislation helps businesses who employ fewer than 500 people support employees as they prevent the spread of or care for loved ones affected by COVID-19. Businesses must follow the below steps to comply, but Federal support is available to offset the costs.

You must provide paid sick leave. Effective April 1, 2020, small-business employers are required to provide up to 2 weeks (80 hours) of paid sick leave for employees who are unable to work due to quarantine, isolation, or coronavirus symptoms. Employees should be paid at their regular compensation rate up to $511 per day. Having the ability to work from home could impact your eligibility for paid sick leave, but clarification on that matter is still to come.

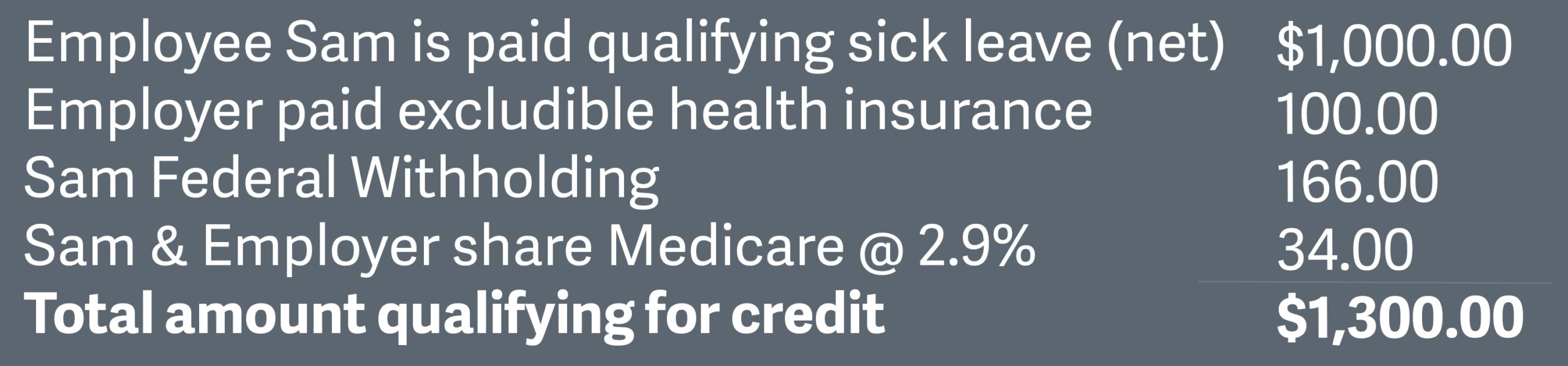

Tax credits will offset the costs of the paid sick leave. Businesses can collect a 100% refundable tax credit on qualified emergency sick leave payments made in each calendar quarter. The tax credit only covers sick leave payments made between April 1, 2020 and December 31, 2020, and as with any tax credit, it’s critical to maintain thorough documentation to justify refundable expenses. This particular credit is allowed against the employer’s share of Social Security and Medicare tax for all employees. See the following example provided by Taxspeaker:

You must allow employees to care for affected loved ones. If employees are unable to work from home and must care for someone in quarantine, isolation, experiencing symptoms or at home due to COVID-related school closures, they are to be covered by the newly expanded Emergency Family and Medical Leave Act. If they’ve been with the company for at least 30 days, employees can take up to 12 weeks of job-protected leave to accommodate family needs related to the coronavirus. During 10 of those weeks, full-time employees are to be paid two-thirds of their regular rate.

Tax credits will offset the family leave expansion. A refundable credit equal to 100% of qualified family leave (up to $200 per day) is available for businesses. Mirroring the paid sick leave tax credit, it’s allowed against the employer’s share of social security and Medicare tax for each calendar quarter. Again, maintain good records to substantiate family leave payments to employees.

The full bill can be found here. https://www.congress.gov/116/bills/hr6201/BILLS-116hr6201eh.pdf

As business owners, we understand the importance of keeping things running, of maintaining productivity and protecting profitability as much as possible. However, these are unchartered waters to navigate, and we must support employees as they prioritize public health. Please contact us if you have any questions about how the Families First Coronavirus Response Act can help your business do so.

Sources:

Category: Tax and Accounting Team