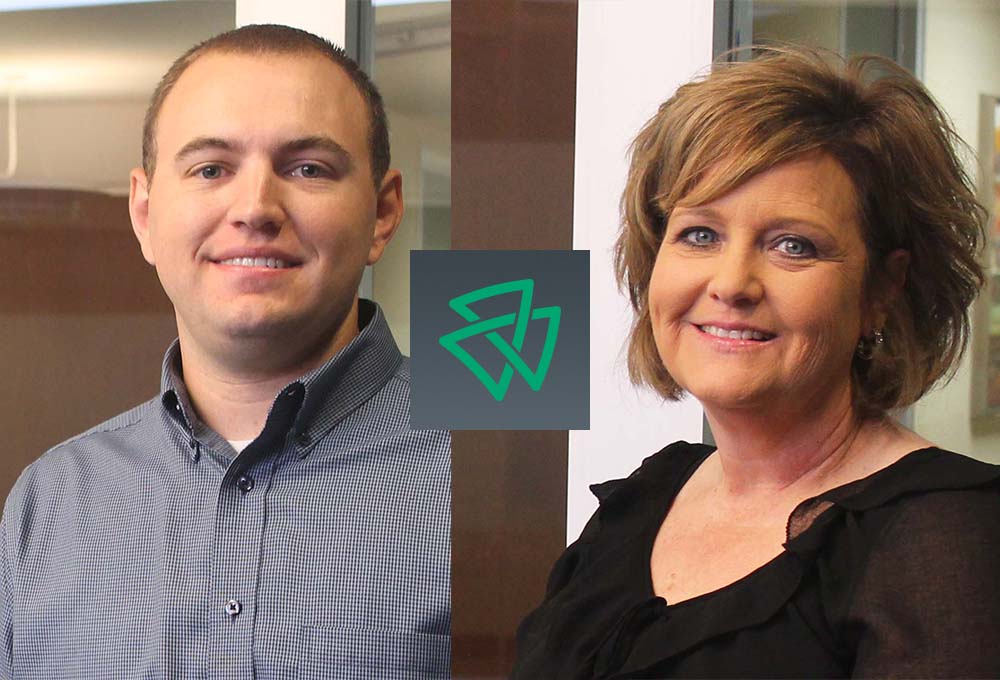

Oklahoma-based wealth strategy firm Wymer Brownlee Wealth Strategies has hired Tyler Miller and Cheryl Quinn as tax advisors in its Oklahoma City office. The additions bring the local staff count to 17, making Oklahoma City the firm’s second-largest location of five offices statewide.

“Tax planning and preparation have become more complex in the wake of tax reform,” said Karen Garrison, tax manager for Wymer Brownlee Wealth Strategies. “However, reform also presents tremendous opportunities, and I’m grateful to have Tyler’s and Cheryl’s talent available to our clients.”

Miller attended Redlands Community College on a full academic scholarship before transferring to Oklahoma State University where he earned bachelor’s and master’s degrees in accounting. Throughout college, he maintained a 4.0 grade point average and went on to win the Oklahoma Society of Certified Public Accountant’s silver medal award in 2016 – an award given to the individual scoring highest on the CPA exam over two windows. While attending OSU, Miller was an accounting intern at the Sonic Drive-In corporate office, and later interned for Ernst and Young where he was hired as a staff accountant upon graduation.

Quinn also attended OSU where she obtained a Bachelor of Science in agriculture. Her diverse experience includes banking where she served as a mortgage loan officer as well as public and private accounting. As an enrolled agent, accountant and auditor, Quinn prepared financial reports and tax returns for more than 100 individuals, partnerships, corporations and nonprofits. She fulfilled human resources functions and managed payroll. Most recently, Quinn was a staff accountant for the Comanche Nation Casino where she prepared budgets and budget projections, monitored expenditures and timelines, and analyzed the facility’s general ledger and departmental information.

Category: Tax and Accounting Team