Trade battles have resulted in market volatility recently, and I’ve been contemplating its impact on our retired clients. Knee-jerk reactions to changes in the market are never wise, but it’s often easier for young investors to wait and see. You can patiently await market corrections when you’re focused on the long-game.

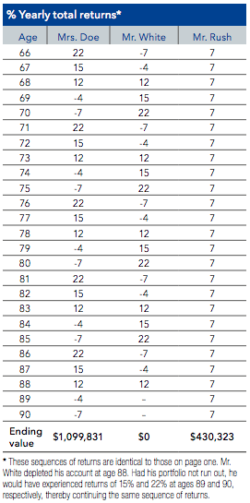

As you near retirement, however, “sequence of returns” becomes a major risk – that is, the impact that the timing of positive or negative returns has on your portfolio when taking distributions. BlackRock illustrated this by comparing three investors with the same starting criteria but drastically different sequences of returns. “Mrs. Doe,” “Mr. White” and “Mr. Rush” were all 65 when they made initial investments of $1 million. They all had an average annual return of 7 percent and took out $60,000 per year (adjusted for inflation). However, over 25 years, the sequence of returns left them with varied ending portfolio values.

Financial advisors, then, must manage the risk to avoid running out of money like Mr. White. Below are three good ways to do so:

- Be flexible with your spending needs. Design a retirement plan around spending a percentage of your portfolio rather than a set dollar amount. This means you’ll pull less from your portfolio when it’s down and possibly more when it’s up. If you’re diligent and don’t overspend in the good years, you could be safer during the bad ones.

- Use a vehicle that provides a guaranteed lifetime income stream. For some clients, annuities with lifetime income guarantees can be hugely beneficial. Every annuity is different and meets a different need, but by using them you can secure lifetime income for you – and sometimes your spouse – to protect against fluctuating portfolio returns.

- Plan conservatively. It’s natural to want to spend everything you can. We all do it from time to time, but when planning for retirement, we need to be as conservative as possible. While it’s important to live life to its fullest and use the resources available to you to do so, living on the edge causes unnecessary stress when large expenses arise.

If you’re retired or getting close to retirement, talk with your financial advisor about potential sequence of return risks and what more can be done to mitigate it.

Blog by Andrew Gaskill, Financial Services Manager.

Note: The rates of return shown above are purely hypothetical and do not represent the performance of any individual investment or portfolio of investments. They are for illustrative purposes only and should not be used to predict future product performance. Specific rates of return, especially for extended time periods, will vary over time. There is also a higher degree of risk associated with investments that offer the potential for higher rates of return. You should consult with your representative before making any investment decision.

Source: https://www.blackrock.com/pt/literature/investor-education/sequence-of-returns-one-pager-va-us.pdf

Category: Financial Service Team, Leaders, Market Matters